Cost-reimbursement contracts are legal agreements that establish a contract’s financial framework. Under this contract type, the government agrees to pay the total project expenses plus additional compensation based on the agreed-upon terms. In essence, it guarantees that contractors are reimbursed for their expenses.

Learn more about cost-reimbursement contracts in this article.

Table of Contents

According to the FAR Subpart 16.3 , a cost-reimbursement contract is a type of government contract where the federal agency reimburses the contractor for all incurred costs while working on a contract. These costs typically include labor, tools, materials, equipment, and other elements essential for project completion.

Before starting the work for the contract, the government and the contractor agree on an estimated initial cost and a spending ceiling. If the contractor needs to spend more than the ceiling amount, it must get approval from the contracting officer. The final cost is then determined based on the actual expenses incurred during the project execution.

Cost-reimbursement contracts are widely used by contractors in construction and software development. In particular, these contractors rely on these contracts to manage project costs more effectively.

Federal entities use these types of agreements to work with government contracting companies and businesses. For instance, the government may award this type of contract to a contractor for a research project where the scope of the work and costs are undetermined.

Cost-reimbursement contracts are most appropriate for projects that have undetermined scopes or higher risks. The contract is typically used when:

The contracting officer must explain why it selected this contract type in the acquisition plan. It must be approved by someone higher up than the contracting officer. Alternatively, the contractors must provide documentation, such as receipts or invoices, to validate reimbursement requests.

Moreover, cost-reimbursement contracts include a provision where contractors can receive a certain amount above the reimbursed costs. This additional amount allows the contractor to cover overhead expenses and potential profit.

However, some contracting officers may impose limits on reimbursement, particularly in case of errors or negligence from the contractor during the project.

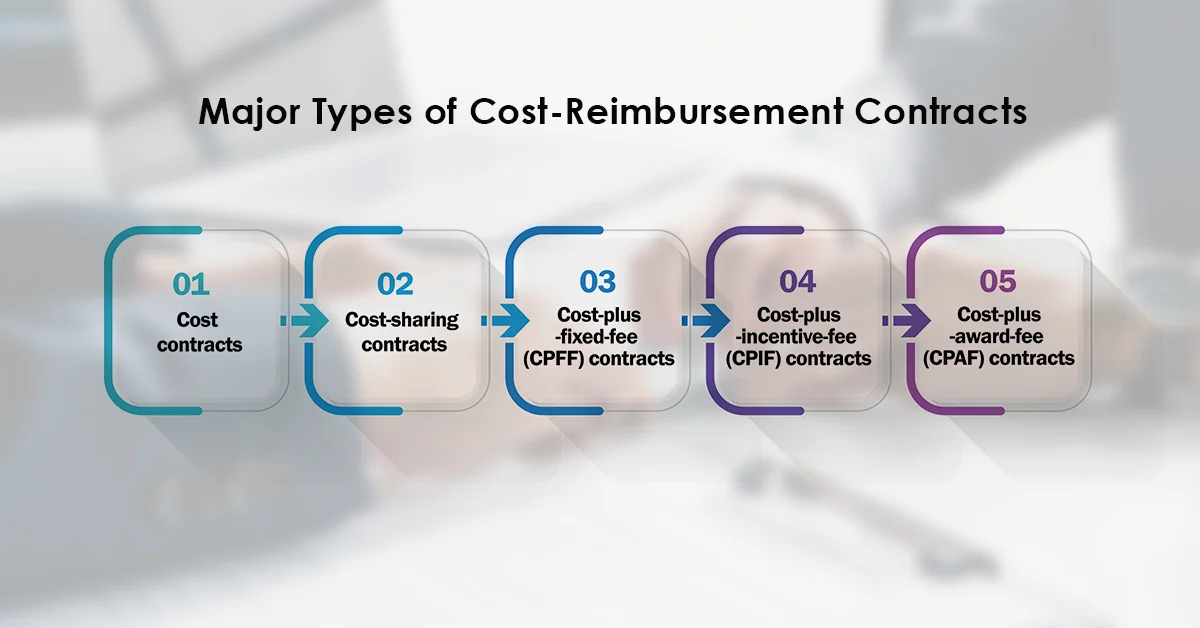

Cost-reimbursement contracts can be classified into five categories. Each serves different purposes and provides different incentives for contractors.

In a cost contract, the contractor is reimbursed for the actual expenses incurred in completing the project with no additional fee. This contract is commonly used in research and development and non-profit projects.

Under a cost-sharing contract, the contractor agrees to bear a portion of the contract costs. The government compensates the contractor only for the agreed-upon portion of those expenses. Similar to cost contracts, the cost-sharing contract has no additional fees.

A cost-plus-fixed-fee contract mandates the government to pay the contractor for the total costs spent on the project plus a negotiated fee finalized during contract discussions. This fee remains fixed regardless of actual costs but may be adjusted if the scope of work changes.

There are two types of a cost-plus-fixed-fee contract, which differ based on the project completion specifics: (1) Completion and (2) Term.

A cost-plus-incentive-fee contract covers reimbursement for costs expended plus an adjustable fee based on the contractor’s performance. In the initial contract clauses, specific targets for costs, fees, and rates for fee adjustment. Throughout the duration of the contract, the performance of the contractor is assessed based on these targets.

If the contractor completes the project at a cost lower than the target cost, it receives a higher fee as an incentive.

A cost-plus-award-fee contract includes a base amount and an award amount. The award fee depends on the contractor’s performance, as evaluated by the government agency.

Cost-reimbursement contracts come with various benefits and setbacks to federal agencies and contractors.

In a cost-reimbursable contract, the majority of the risk falls on the government. It is obligated to reimburse all allowable expenses incurred by the contractor during the project. The government is also accountable for any additional costs during the project execution.

Put simply, if the project exceeds the initial cost estimate, the government bears the financial burden.

The main difference between a fixed-price and a cost-reimbursement contract lies in the management of project costs. In a fixed-price contract, the contractor and the government agree on the specific scope and costs for the project before the work starts.

Meanwhile, the contractor is reimbursed for all expenses accumulated during the project, along with additional fees, in a cost-reimbursement contract.

Cost-reimbursable contracts and time and material contracts are both useful when the project’s final cost is difficult to determine. However, they differ in terms of profit management.

Fees are marked up in a time and material contract to guarantee profit. On the other hand, contractors bill for all expenses plus an additional separate fee for profit based on the agreed-upon percentage of the contract’s total cost.