Difference Between Gross Total Income (GTI) and Total Income (TI)

Most of the people have no idea about the income on which tax is levied and due to which they face trouble in ascertaining their taxable income and filing their return. As per the Income Tax Act, a person can earn income from different sources and these sources, are categorised as heads of incomes. In the context of income tax, the terms gross total income and total income are often used, wherein gross total income is the aggregate of income calculated under the five heads.

On the other hand, total income is the income on which income tax to be levied is calculated. In this article, we are going to talk about the difference between gross total income and total income, along with the step by step process of income tax calculation.

Content: Gross Total Income (GTI) Vs Total Income (TI)

- Comparison Chart

- Definition

- Key Differences

- Conclusion

Comparison Chart

| Basis for Comparison | Gross Total Income (GTI) | Total Income (TI) |

|---|

| Meaning | Gross Total Income is the aggregate income of a person, arrived after adding up income from all the five sources. | Total Income refers to that income of the assessee on which the tax liability is calculated. |

| Deductions | Income before making deductions under Chapter VI-A | Income after making deductions under Chapter VI-A |

| Tax | Tax is not levied on this income. | Tax is levied on this income. |

Definition of Gross Total Income (GTI)

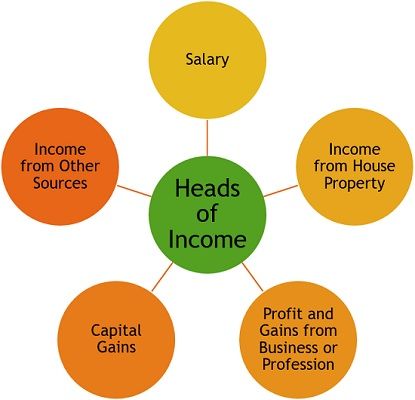

Gross Total Income or GTI refers to the sum of the income calculated under each head of income, i.e. salary, house property, business or profession, capital gains and other sources, once you provide for clubbing of income and set off and carry forward of losses. The steps to calculate gross total income are given as under:

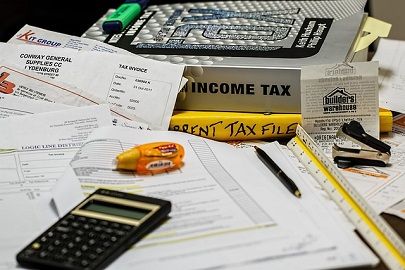

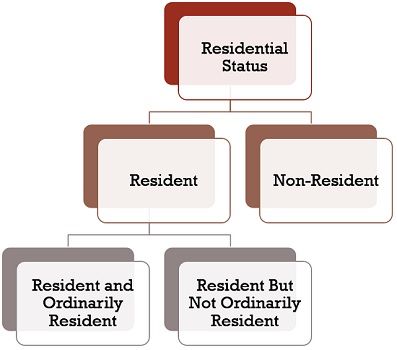

- Identification of Residential Status: A person’s residential status plays a key role in ascertaining the income which should be included in the taxable income of the person.

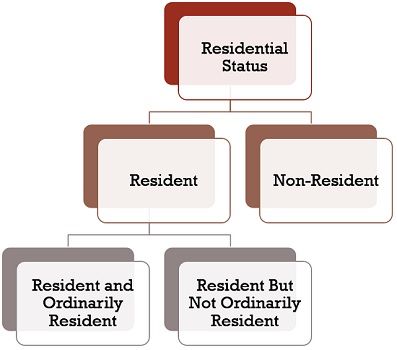

- Income Classification: As per the Income Tax Act, the income is categorized under five heads of income, which covers almost all types of sources through which one can receive income. These are:

- Salary: As the name suggests, it takes into account all the receipts and perquisites from the employer, including pension

- Income from House Property: It covers rental income.

- Profit and Gains from Business or Profession: It includes profits generated from the running the business or receipts from the profession.

- Capital Gains: Profits on the transfer of movable and immovable property.

- Income from Other Sources: All the incomes which are not covered under the above heads are taken to this category, such as interest income, royalty, winning from lottery/crossword puzzle, etc.

- Calculation of Income under each head: Income should be calculated as per the rules of the specific head of income, under which the source is covered. There are some specific incomes which are completely exempt from the tax and such incomes are not added up in the gross total income like income from agriculture. Along with that, certain incomes are exempt from tax up to a certain extent.Further, there are certain deductions and allowances stipulated under each income head, which are to be taken into account before arriving at the net income.

- Clubbing of income: To prevent the avoidance of tax, rules related to clubbing of income is applied, in which income earned by the spouse or minor child is included in the income of the assessee.

- Set-off or Carry forward and set off of losses: There may be various income sources under the same head, wherein the assessee may be receiving profit from one source and incurring a loss from the other. And so, the loss from one business is set off against the profit from the other source, under the same head. In the same way, there are certain provisions regarding the inter-head adjustment of losses wherein loss from one head is adjusted from the loss of another head.

- Calculation of Gross Total Income: At the end of the process, the final figures of income or loss under each head is computed, after making deductions and other important adjustments, and providing for clubbing of income and set-off and carry forward of losses.

Definition of Total Income (TI)

Total Income or TI is that income of an assessee on which tax liability is calculated. To arrive at the total income of the assessee one has to calculate the gross total income of assessee (steps are already mentioned above). In addition to this, below-given steps are followed:

- Deductions from Gross Total Income: After the calculation of Gross Total Income of the assessee, there are certain deductions which are to be allowed from the Gross Total Income. Here, it must be noted that deductions are availed by those assessees only whose Gross Total Income is showing a positive figure. Further, there are certain provisions regarding deductions which must be considered while allowing them. Now, the deductions are divided into three kinds:

- Deduction concerning investments made, such as Life Insurance Premium paid, Medical Insurance premium paid, Contribution to provident fund or pension fund, contribution to political parties and so forth.

- Deduction concerning certain incomes such as the income of cooperative society, royalty income of authors of certain books (not including textbooks), royalty on patents, the profit of enterprises involved in infrastructure development, the profit of enterprises engaged in the development of the special economic zone.

- Other deductions

- Calculation of Total Income: Once all the relevant deductions are claimed, from the GTI, the amount left is the Total Income, which needs to be rounded off to Rs. 10.

- Surcharge/Rebate and Cess: Once you arrive at the Total Income of the assessee, tax rate applicable as per the rules of Income Tax Act are applied, so as to determine the income tax liability. Further, the surcharge is added to and any rebate thereof is reduced from the income tax liability (if applicable). Along with that, education and secondary education and higher secondary education cess (if applicable) are added to the income tax, at the applicable rates.

- Advance Tax and TDS: After determining the actual tax liability of an assessee for the year, any advance tax paid, or Tax Deducted at Source, is then adjusted, to arrive at the net tax payable or refundable, which is again rounded off to the nearest Rs. 10.

Key Differences Between Gross Total Income and Total Income

The difference between gross total income and total income can be drawn clearly on the following grounds:

- Gross Total Income means the overall income of the assessee calculated under each head as per the rules of the Income Tax Act and after giving effect to the clubbing provisions and set off of losses. On the other hand, Total Income refers to the income of the assessee on which tax liability is determined.

- Gross Total Income, as its name suggests, is the income before allowing deductions as per section 80C to 80U. As against, Total Income is the income which is arrived at after making deductions.

- Tax is levied on Total Income, and not on Gross Total Income of the assessee.

Conclusion

With the above discussion, one thing must be clear to you that tax is always applicable on the total income of the assessee, calculated with a step by step process, wherein first of all Gross Total Income is determined and after which deductions are made to reach the total income figure. So, we can say that: TI = GTI – Deductions.