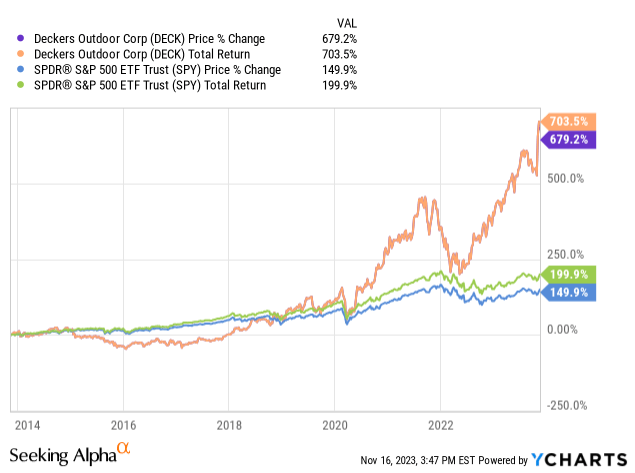

Deckers ( NYSE:DECK ) is a small to medium-cap company that has experienced tremendous growth in recent years, particularly propelled by its Hoka brand. Despite a 62% hike year-to-date, I believe it is on track to continue its winning streak. This is mainly due to its effective management with strong incentives, linear growth along with high margins and returns on capital, and a relatively reasonable, perhaps even cheap, stock price.

Hoka and Ugg stand as Deckers' primary brands, collectively commanding 92% of the company's revenue. Therefore, these are the brands I'll be delving into today.

Hoka, a red-hot running shoe, has taken the world by storm with its unconventional and colorful design. Its standout feature lies in its remarkable comfort, thanks to a substantial sole that not only sets it apart visually but also contributes to its comfort factor. Aligning with the trend of unique and slightly eccentric footwear, akin to the rise of brands like Crocs ( CROX ), Hoka, founded in 2009, initially gained popularity among adults due to its comfort. However, in recent years, its sales have surged globally, attracting a younger demographic of runners. The brand has become so influential that fan groups have emerged around its products. Time Magazine even recognized it as one of the top 100 influential companies in 2023.

Experiencing significant growth in recent years, with a 27% YoY increase in revenue in the most recent quarter, Hoka boasts a savvy marketing team. I anticipate substantial future growth for the brand, both domestically and internationally. Additionally, owing to its quality products, Hoka enjoys strong brand loyalty, with customers becoming frequent buyers. Given the contemporary emphasis on comfort, there's potential for Hoka to expand beyond running and trail shoes into the realm of fashion, especially if they introduce more casual footwear. As a sneaker enthusiast operating on StockX, who earlier this year nominated Hoka as the number one growing brand, aptly stated in an interview with The New York Times:

"I live here in Miami, and I see people in Hokas in restaurants and bars," Mr. Haines said. "It's a comfort thing but also a form thing. People are wearing them because it's stylish and trendy."

Hoka's marketing team has excelled in building connections with athletes through sponsored running events, the 'Fly Human Fly' campaign, and collaborations with other prominent brands such as Moncler (OTCPK:MONRF). Its strength lies in the strategic decision not to compete directly with industry giants but rather to carve out its unique category, akin to the successful approach taken by Lululemon (LULU) with yoga pants.

Decker's objective is to build HOKA into a multibillion-dollar performance brand.

Ugg, renowned for its enduring sheepskin products and high-quality, long-lasting shoes, has been a stalwart brand. While it played a pivotal role as a massive growth driver in the 2000s, its momentum continues, with a remarkable 28% YoY growth.

During the 2000s, Ugg boots experienced a surge in popularity:

"I vividly remember my first days at a new middle school in fall 2008: I was extremely glad to own a pair of UGG boots, as when I got to the new school, I discovered that every other girl in my class was wearing them every day. Like Justin Bieber, the UGG boot was king."

Like every brand striving to maintain its influence, although exceptions exist, such as with brands like Hermes, Ugg experienced a slowdown in its trend. However, Ugg adeptly pivoted by leveraging its comfort-focused, furry brand into other product categories such as HomeGoods and clothing:

"In 2013, UGG began offering a line of homegoods, such as towels, pillows, blankets, and baskets. This is a stellar growth strategy example, as soft homegoods build on UGG's touchable image. Note the timing of this occurrence: just as the boots were going out of style."

Another strategy, akin to Hoka's approach, involves embracing the weird and unique. Ugg has engaged in collaborations with brands like Telfar, Madhappy, and others.

Deckers' objective for Ugg is to foster growth through Direct-to-Consumer connections, emphasizing elevated products and experiences. As I will delve into later, Deckers possesses the necessary experience to effectively navigate Direct-to-Consumer challenges.

The primary risk inherent in every fashion brand lies in the potential loss of relevance. Throughout history, consumer preferences have demonstrated a tendency to evolve, turning today's successful product into tomorrow's forgotten trend. Thus, effective management is crucial for fashion brands. The risk, even though Hoka and Ugg are currently popular, is that their brand trends may fade, resulting in a decline in growth rates. Consequently, fashion companies must diversify their portfolios.

Drawing a parallel with LVMH (OTCPK:LVMHF), while it's unlikely that Dior will lose its appeal soon, they have a robust backup from other successful brands like Louis Vuitton, Tiffany, and more.

The challenge lies in executing diversification successfully without losing focus on what brought the brand to its current status. Crocs made this mistake in the past but executed a perfect turnaround. I wouldn't be surprised, and in fact, I would welcome the idea, if Deckers were to explore strategic acquisitions with a long-term perspective.

Another primary risk, of course, is competition, given the intense nature of the fashion and apparel market where emerging brands can swiftly capture market share.

I also harbor concerns about Deckers' pricing power. While Hoka already commands a substantial price tag, the prospect of consumers purchasing running shoes at a price north of $280, as well as the pricing dynamics for Ugg, raises potential challenges. These two brands occupy a middle ground between casual and luxury, and a severe bout of inflation could conceivably impact their margins. On a positive note, during the recent inflationary pressures in 2022, there was a minor decrease in margins.

I believe the current management team at Deckers is well-suited for the company's needs. The CEO, with extensive experience in transitioning to Direct-to-Consumer models, has performed well since taking on the role in 2016. Dave Powers has maintained profitable growth, improved margins, and achieved a high return on capital.

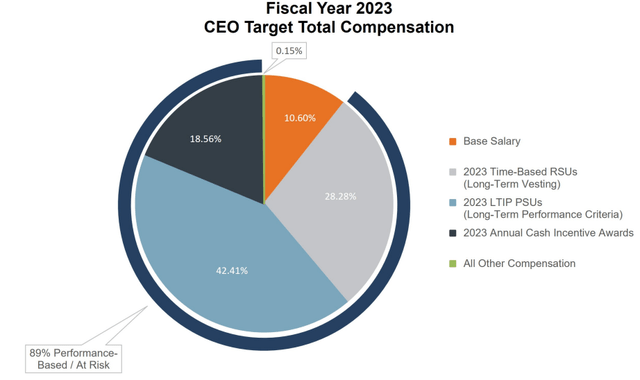

The addition of the Chief of Fashion and Lifestyle, Mrs. Spangenberg, brings valuable expertise, even though she is relatively new to the position. Her experience at major brands like Nike and Gap adds depth to the leadership team, which is important because future fashion innovation will be necessary to sustain the brand's image. The executives' compensation structure appears favorable, aligning with shareholders' interests. Notably, 89% of the CEO's compensation is unsecured, meaning performance delivery is essential. Out of the total compensation, 70% is in equity, aligning the executive team's interests with potential shareholders. This compensation structure is similar to that of other executives and directors.

While the CEO holds approximately 0.2% of the company with just over 60K shares, the total executive team's ownership is relatively minor at 0.5% of the total company. It's important to note that Deckers is not a founder-led company.

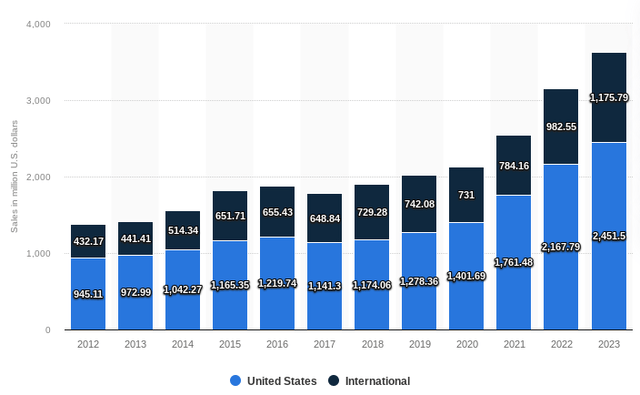

Deckers has been a massive growth story, experiencing a 14% CAGR in revenue over the last five years, notably accelerating to a 20% CAGR in the past three, particularly since the onset of Covid. This growth has been propelled by a transition to more Direct-to-Consumer channels, both in physical stores and online, with a remarkable 38% growth in Q2 FY24. Another significant driver is international expansion, with global revenue steadily claiming a larger share in the income statement, currently comprising 32% of total revenue and growing by 33% in the last quarter.

The management's performance has been commendable, evident in a 47% YoY growth in customer acquisition and a 51% growth in customer retention last year.

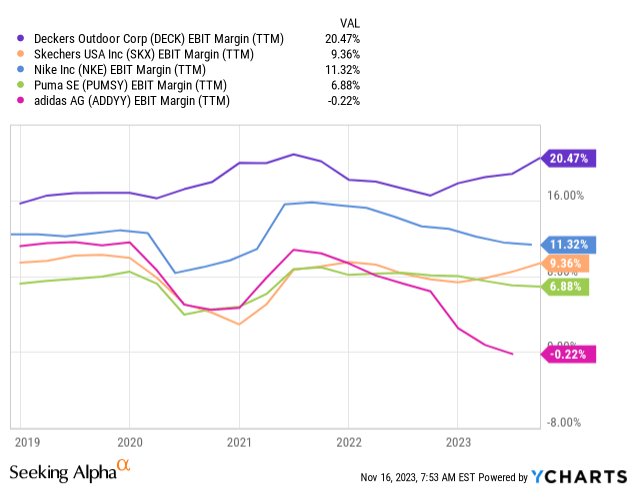

This robust growth is not hollow; it comes with substantial Free Cash Flow generation. The company's FCF is outpacing revenue growth, a testament to effective management, reflected in operating margins at 19% and still increasing. A comparison of Deckers' numbers to those of its peers underscores its strong margins. High margins afford a company the luxury to focus on growth initiatives without the constant concern about cash availability. Furthermore, these high margins provide a buffer against inflation; while increasing wage costs may exert some pressure, they are unlikely to compromise buyback programs or investments in future growth.

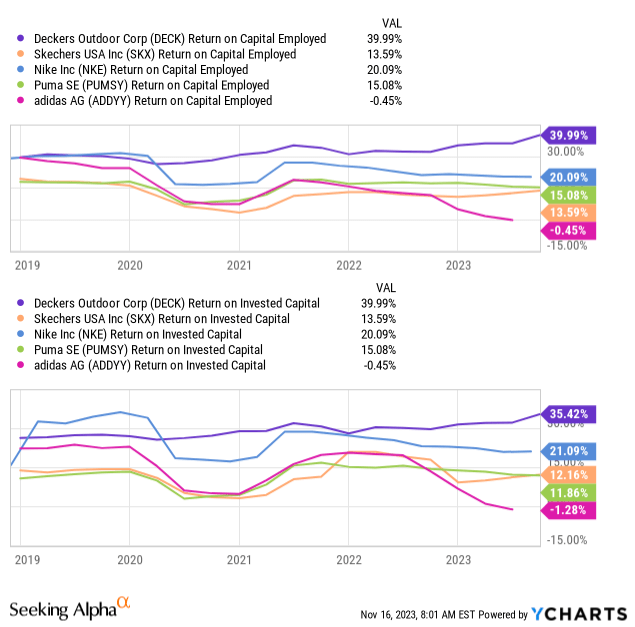

These high margins contribute significantly to the success of the company, standing alongside revenue growth, high return on capital, and stability, with the added advantage of it is growing. A recent study by Morgan Stanley highlighted that companies with high and growing spreads between the WACC and Return on Invested Capital tend to outperform. Deckers' returns are notably high even without employing leverage. Moreover, the returns have demonstrated stability over time, indicating the company's ability to create value consistently over an extended period. When coupled with linear revenue growth, this forms the foundation for a massive compounder. Notice how these Return on Capital figures are substantially higher than those of all Deckers' peers.

Deckers is in an excellent financial position for long-term success, boasting zero debt, and strong liquidity, with a current ratio almost at three, and a quick ratio above 1. The Altman Z score is above 10. There seems to be no need to delve further into the topic, as Deckers' financial position is robust.

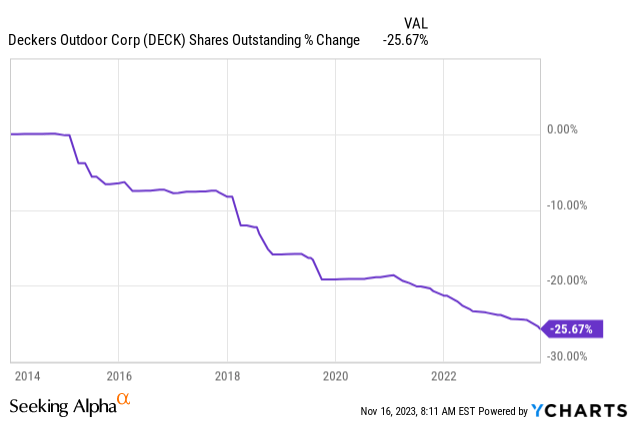

The company can be classified as a 'share cannibal.' Despite not paying dividends, Deckers returns capital to shareholders through consistent buybacks, successfully reducing the share count by about 2.5% annually over the last 10 years. This aligns with a common feature among compounders, seen in examples such as AutoZone (AZO), O'Reilly (ORLY), Apple (AAPL), and Lowe's (LOW). Such share buybacks are a significant boost to Earnings Per Share, especially when the stock price is at a reasonable level. While achieving margin expansion can be challenging at times, reducing the share count, especially when the stock is reasonably priced or even cheap, is an excellent strategy to enhance EPS and deliver higher total returns for shareholders. It's another commendable move in capital allocation by the management.

Deckers is trading at a reasonable valuation in my view. Although a price-to-earnings ratio of 27 may seem a bit high, I don't consider it to carry a hefty price tag given the demonstrated quality of the company. Factors such as a debt-free status, robust and profitable brands, solid top-line growth, expanding margins, and consistent buybacks contribute to this perception.

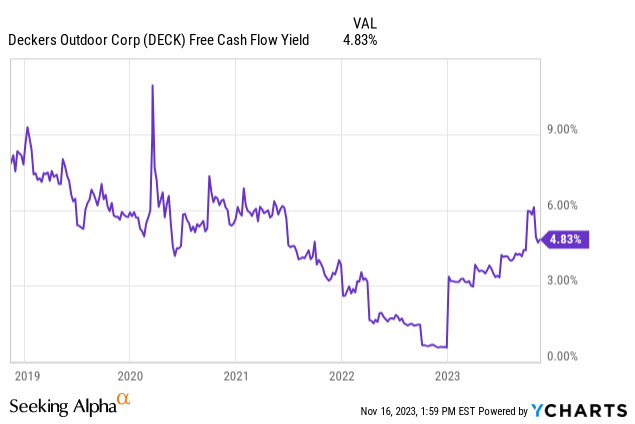

Based on management guidance, net sales for FY 24' are expected to be around $4.02 billion with an 18.5% EBIT margin. This represents an 11% growth in EBIT from the previous year, resulting in a relatively high PEG ratio of 2.4. While this may seem elevated, Deckers presents a high Free Cash Flow yield of 4.8%, which is somewhat uncommon for companies with a high Return on Capital Employed. Considering these factors, I currently don't see a bargain in terms of multiples valuation.

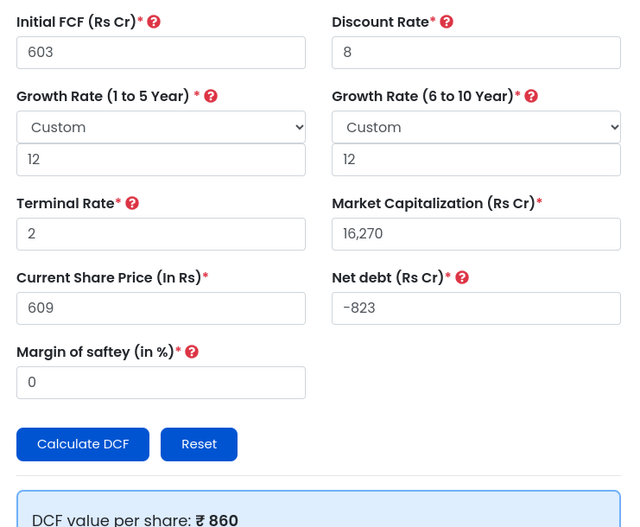

However, shifting focus to the Discounted Cash Flow analysis, the outlook appears different. The key inputs include a 2% terminal growth rate, an 8% discount rate derived from the WACC by Alpha spread. The Free Cash Flow I've used assumes $4.02 billion in sales with a 15% FCF margin, based on recent FCF margins. The FCF growth input is set at 12%, aligning with analysts' revenue projections for the next three years. I've taken a conservative approach, assuming no margin growth or share repurchases. It's worth noting that Deckers has consistently surpassed analysts' expectations over the last decade, indicating that actual growth may outpace these projections. The resulting calculation indicates that the stock is undervalued by 29%, with an intrinsic value of $860.

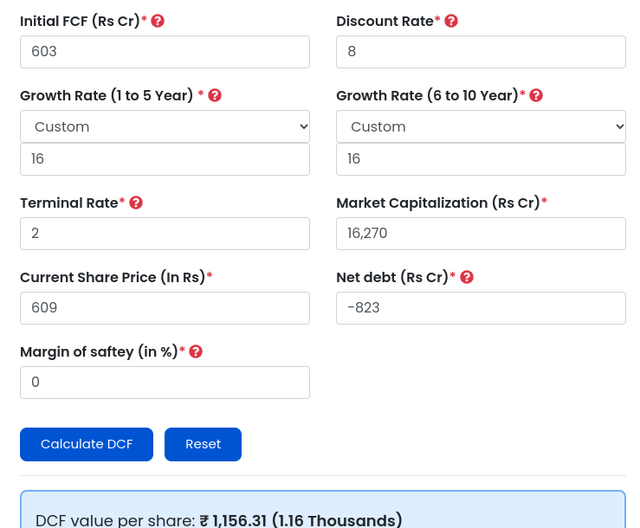

With these realistic assumptions in mind, let's explore two additional scenarios. In the first case, if we assume the Free Cash Flow per share will grow similarly to analysts' Earnings Per Share projections for the next three years at a 16% CAGR, which is quite likely given Deckers' track record of surpassing analysts' estimates, the stock would represent a bargain. The intrinsic value would be $1156, indicating a 47% undervaluation.

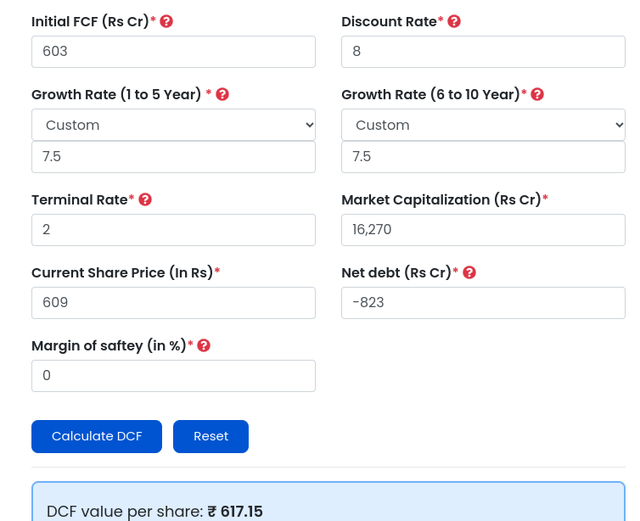

In the third scenario, I plan to conduct a reverse discounted cash flow analysis to gauge the growth implied by the current price and assess its likelihood, in my view. With a stock price of 609, the suggested free cash flow growth rate is approximately 7.5%. While not entirely implausible, I consider such a rate unlikely in the next couple of years. The compelling combination of robust brand power, customer retention, the shift to Direct-to-Consumer, and share buybacks could potentially drive margin expansion, leading to a substantial increase in Earnings Per Share.

Furthermore, it's worth noting that this growth falls significantly below analysts' revenue expectations.

While I don't have the exact reason why investors undervalue this company, my assumption is that they may be concerned about the sustained growth of Hoka and the ongoing relevance of Ugg. Additionally, Deckers is essentially a holding company and such entities often have a more cautious outlook. Furthermore, markets typically lack a long-term perspective, and the possibility of rough economic times could result in lower growth rates. Nevertheless, taking a long-term view of the company suggests the potential for significant returns.

While I may not perceive Deckers as a wide-moat company, I do anticipate it will continue to outperform the market. The presence of effective management, two robust main brands, consistently high and growing returns on capital, expanding margins, and a debt-free status are noteworthy strengths.

The primary risk of a potential loss of relevance in the fiercely competitive fashion industry should not be underestimated, constituting the main challenge to my thesis. Additionally, the valuation does not indicate a bargain according to various metrics, in contrast to the Crocs case where significant undervaluation is evident across all measures. To monitor these risks, I plan to track Hoka's + UGG brand power through social media and Google Trends, analyze customer acquisition reports from Deckers, and closely observe the Direct-to-Consumer transition.

Considering these factors, coupled with what I consider a favorable valuation, I am inclined to classify it as a STRONG BUY, even after its impressive 63% year-to-date return. I'd be interested to hear your thoughts on this assessment.